does san francisco have a payroll tax

Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated. Since 1995 the payroll tax rate has.

Prop F San Francisco S Sweeping Business Tax Overhaul Wins Big

Get Started With Limited Offers Today.

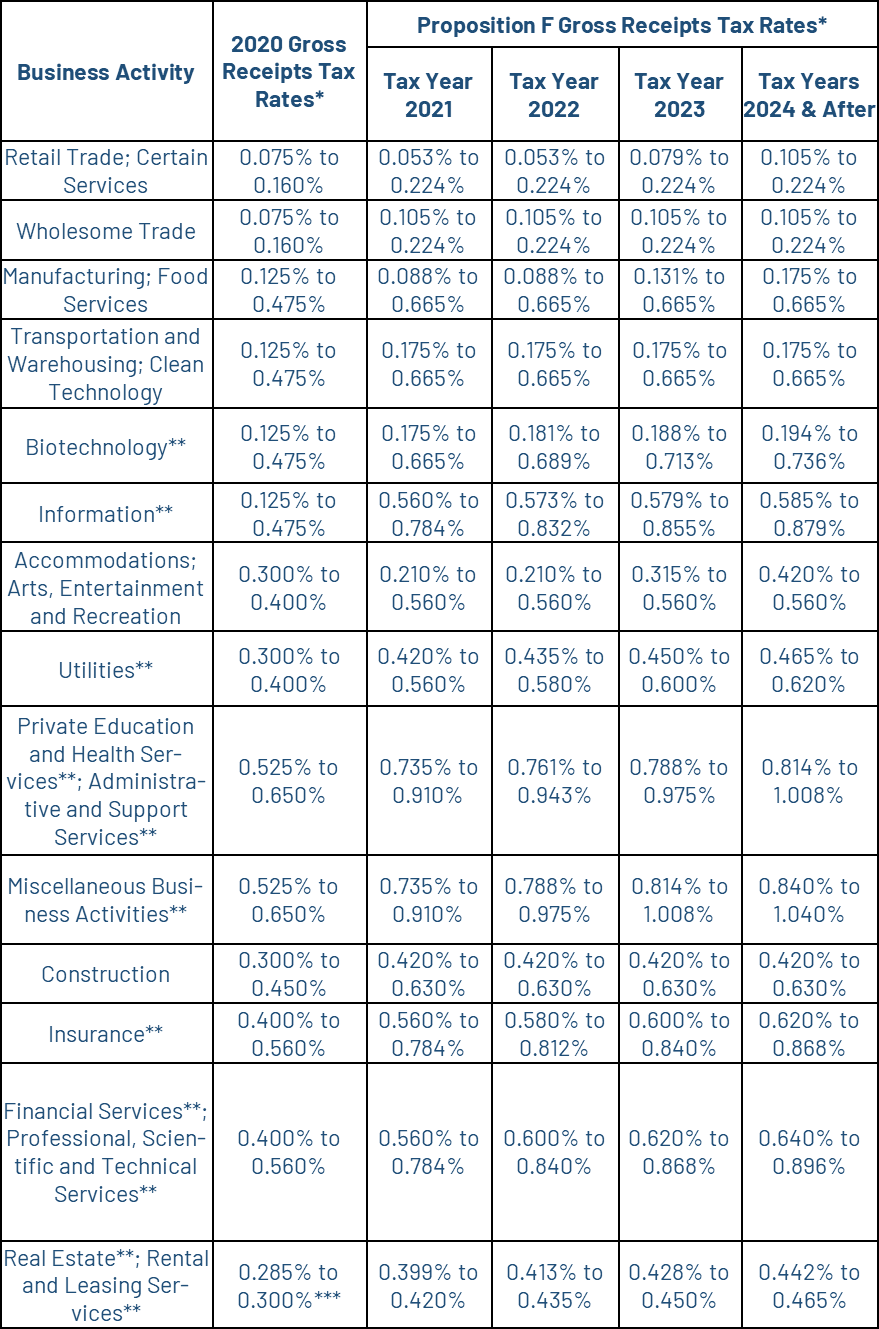

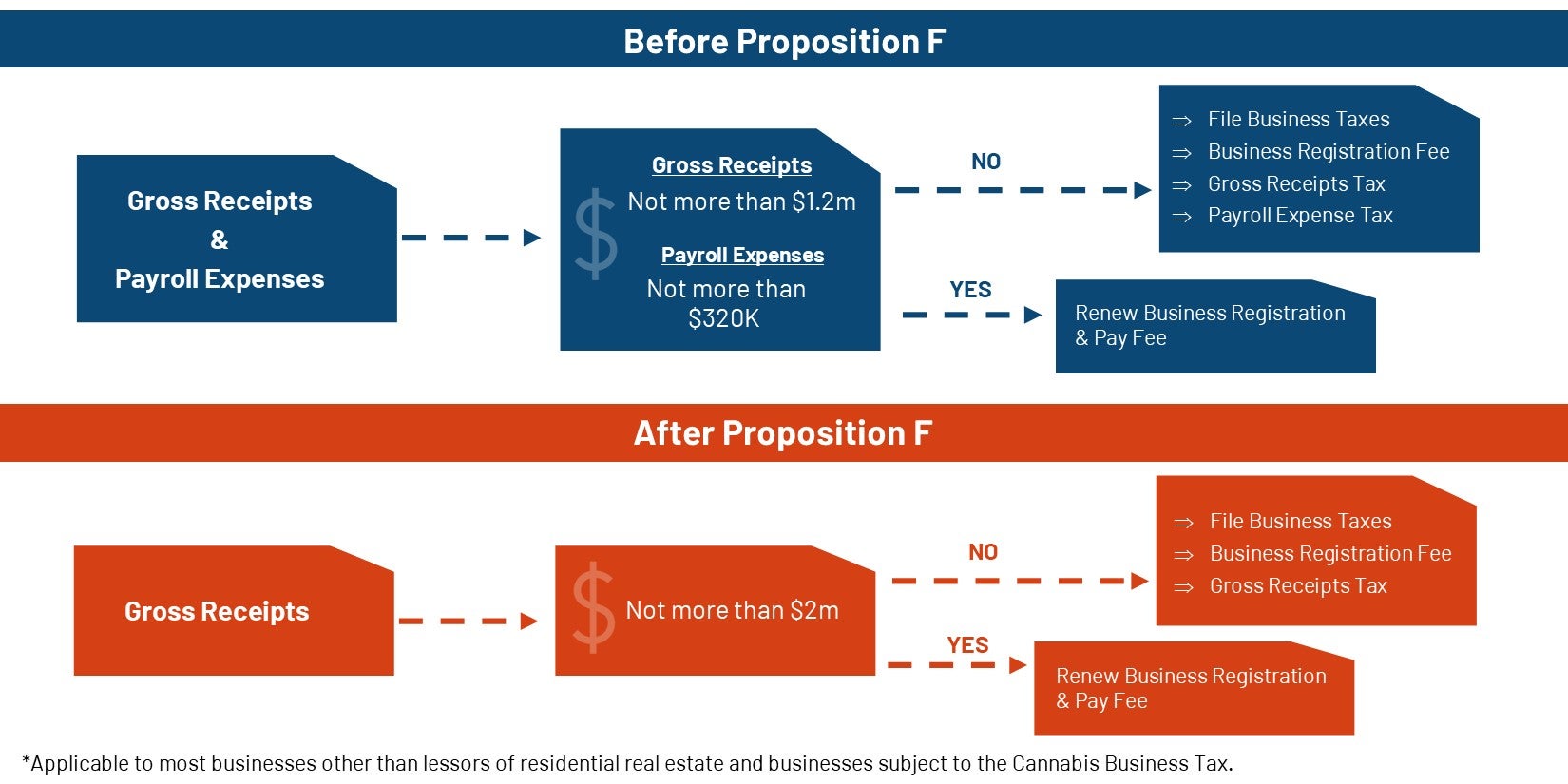

. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. San Francisco Business and Tax Regulations Code Annotations Off Follow Changes Share Download Bookmark Print Editors note. From imposing a single payroll tax to adding a gross receipts tax on.

This is the total of state county. California has four state payroll taxes which we manage. Ad Find 10 Best Payroll Services Systems 2022.

San Francisco Payroll Expense Tax FEDERAL Withholding 2021 2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion California Individual. Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Payroll Expense Tax. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

Nonresidents who work in. Proposition F fully repeals the Payroll Expense. In most cases youll be credited back 54 of this amount for paying.

Proposition F fully repeals the Payroll Expense. But it kept the basic structure of the gross receipts tax untouched and for most companies that tax is a stealth payroll tax. Top Quality Payroll Tax Services Ranked By Customer Satisfaction and Expert Reviews.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Does san francisco have a payroll tax Monday June 13 2022 Edit. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Ad See 2022s Top 10 Payroll Tax Services.

Article 12-A the Payroll Expense Tax Ordinance was. Nonresidents who work in San Francisco. Ad Focus on Running your Business with the Right Payroll Solutions.

What Is Tax In San Francisco. About a decade ago a coalition of 68 companies. Affordable Easy-to-Use Try Now.

Ad Find 10 Best Payroll Services Systems 2022. Payroll Seamlessly Integrates With QuickBooks Online. San Francisco used to have both a payroll tax and a gross receipts tax in place with firms paying whichever was higher.

All 92 counties in Indiana have an individual income tax ranging from 15 in Vermillion County to 285 in Pulaski County. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required.

Take Advantage of Everything Payroll Has To Offer. Over the years the payroll tax rate has changed from a low of 11 percent to a high of 16 percent. Payroll Seamlessly Integrates With QuickBooks Online.

Which state has the highest tax rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxesThe Tax. Thats because San Francisco asks businesses to.

Allen County levies an income tax at 148. Get Instant Recommendations Trusted Reviews. Solved The minimum combined sales tax rate for San Francisco California is 85.

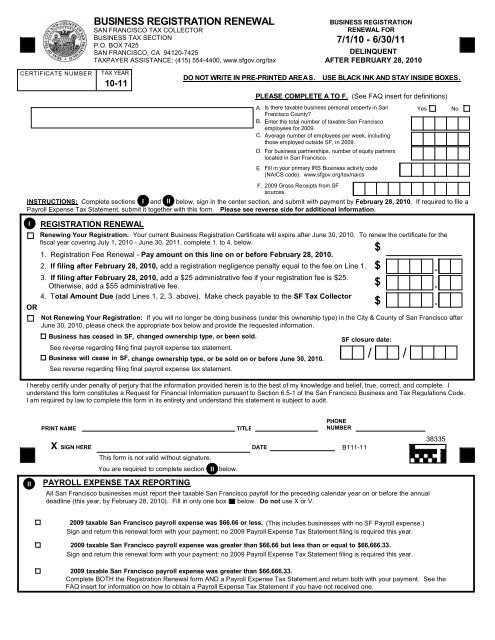

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment. Affordable Easy-to-Use Try Now.

San Francisco residents also have to pay a 038 payroll tax there are no other local income taxes in California income tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. The payroll tax became effective on October 1 1970.

Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense in San Francisco in lieu of the additional gross receipts tax.

Gross Receipts Tax Gr Treasurer Tax Collector

Remote Announces Partnership With Greenhouse Software Citybiz

San Francisco S New Local Tax Effective In 2022

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco Will Tax Employers Based On Ceo Pay Ratio

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2009 Lg Payroll Tax Statement And 2010 2011 Registration Form

Annual Business Tax Returns 2021 Treasurer Tax Collector

State Payroll Taxes Guide For 2020 Article

Tax Solutions Tax Services 4751 Mission St San Francisco Ca Phone Number Yelp

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Democrats Seize On Trump S Payroll Tax Deferral As An Attack On Social Security Medicare Politico

Twitter Will Get Payroll Tax Break To Stay In S F

Local Income Taxes In 2019 Local Income Tax City County Level

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

San Francisco Controller Publishes Candid Report On How Badly They Need Twitter Techcrunch

San Francisco S Confusing Business Taxes Could Get Another Overhaul San Francisco Business Times

Twitter Cuts Oakland Office Space Reducing San Francisco Footprint